Leading French mutual insurer embraces SaaS technology to streamline costs, shorten processing times, and improve service delivery

Munich Re Automation Solutions has today announced that Macif, one of France’s top mutual insurers, will implement its cloud-based underwriting platform, ALLFINANZ SPARK, alongside the Insight Origin analytics module. The decision underscores Macif’s ongoing focus on digital transformation, operational agility, and delivering a seamless customer experience.

By adopting SPARK, Macif aims to strengthen its underwriting efficiency and better navigate complex regulatory environments, while aligning its services with the growing expectations of today’s digital-first insurance customers.

This strategic step also reinforces Macif’s commitment to scalable technology and data-driven decision-making, helping the insurer remain competitive in a rapidly evolving marketplace.

Alby van Wyk, Chief Commercial Officer at Munich Re Automation Solutions, said:

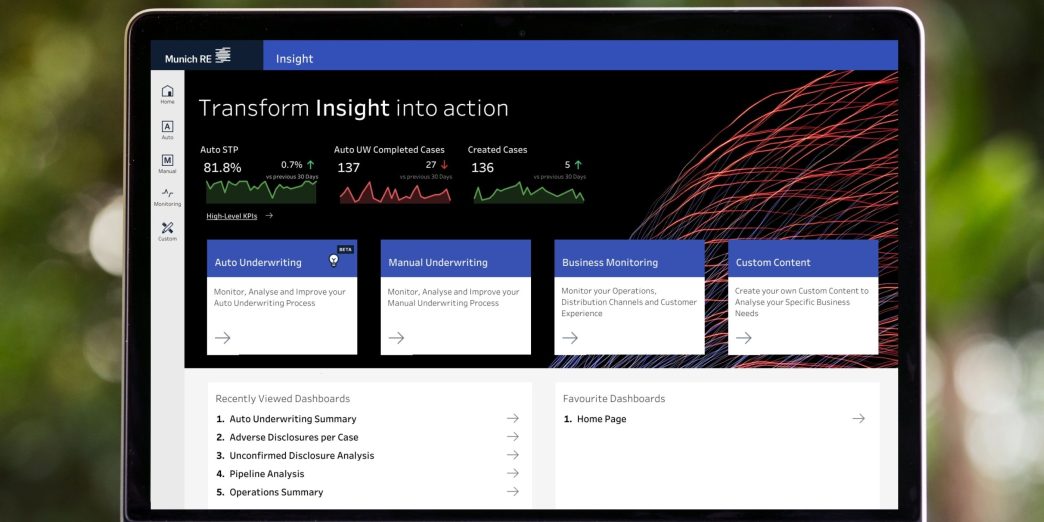

“We are very pleased to partner with Macif in the French market. ALLFINANZ SPARK will provide Macif with immediate underwriting decisions to enhance their straight-through processing (STP) rates, while our Insight Origin analytics module will offer quarterly reports to monitor and evolve underwriting results. The adoption of our best-in-class SaaS solutions will deliver improved customer experience for Macif, as well as increased efficiency to drive sales and reduce costs, all while managing risk.”

Fréderic Nouvian, Chief Operating Officer at Macif Health and Personal Protection, said:

“Building digital leadership is an essential part of Macif personal protection. As more of our clients prefer to engage with us digitally, we believe that by enabling straight-through processing using the underwriting platform of Munich Re Automation Solutions, we will be able to deliver quicker and more efficient services to our clients. Productivity gains are also a strong marker of our choice. Finally, the chosen tool will also allow our medical service to maintain a high degree of autonomy in assessing medical acceptance rules.”

By adopting Munich Re Automation Solutions’ SaaS-based underwriting and analytics platform, Macif gains a scalable, cost-effective solution that integrates seamlessly with existing systems and accelerates time to market.

ALLFINANZ SPARK by Munich Re Automation Solutions is a cloud-based digital underwriting and analytics solution designed to enhance sales growth and transform customer buying experience. Its key features include the Rulebook Hub for creating and managing underwriting rules, the Underwriting Engine for automatic decision-making, and various integration services for seamless connectivity with other systems. SPARK enables insurance companies to modify underwriting rules to reflect their individual philosophy and changing business strategies, thus helping them establish faster sales processes and improve customer engagement.

Insight Origin is a comprehensive suite of interactive dashboards, allowing users to gain deep insights into their underwriting data. It enables collaboration and the sharing of insights with decision-makers across the company. Users can monitor the underwriting process, analyse underwriting volume and trends, rules, disclosures, and evidence requirements, as well as the manual underwriting process, distributors and agents, and rule disclosure errors.