Digital bank and fintech leader Black Banx emerges as the wise man of the digital trading world in a world where tweets have the power to sway stock markets and hashtags are used as gauges of market conditions.

Black Banx has built a reputation for successfully navigating tumultuous markets, and it has established itself as a reliable partner and advisor for companies looking to thrive in a time of digital upheaval.

The interplay of these sectors has given rise to numerous difficulties that call for research and comprehension as the world of online commerce keeps expanding its bounds and social media becomes an ever-present force.

The basics of online trading

Today’s traders are more likely to be found drinking coffee while quietly navigating a virtual world of stocks and commodities. By democratising access and changing the trading environment, online trading has changed how financial markets function.

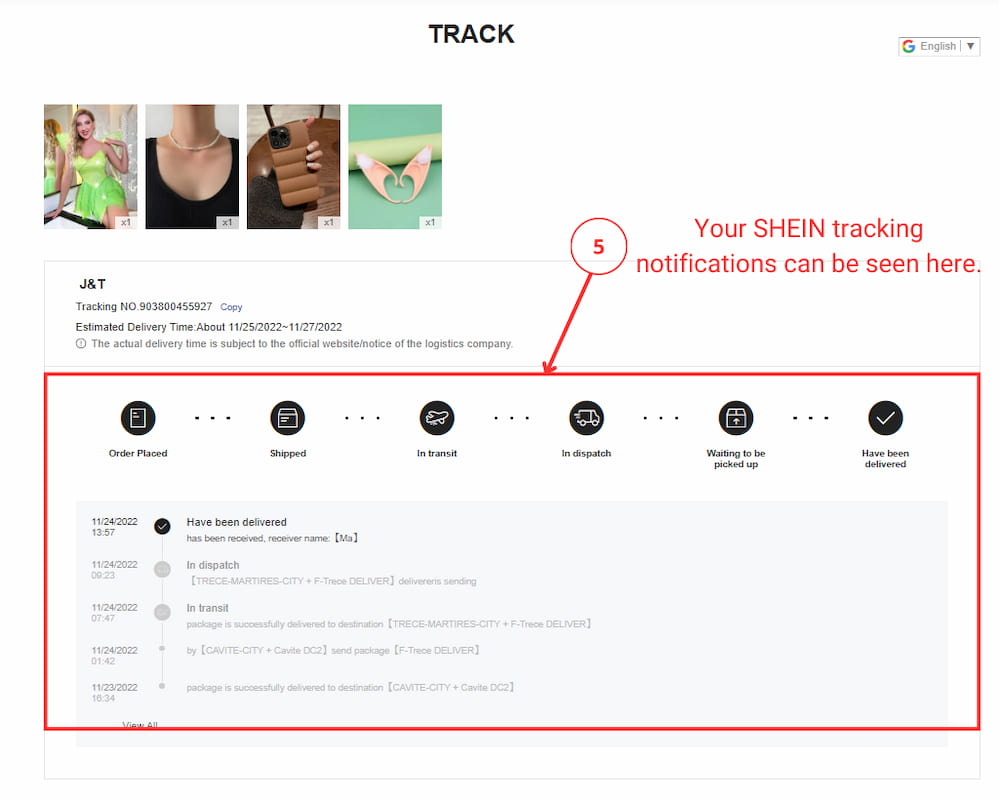

Prior to the 1990s, brokerage houses made few marketing-related attempts to draw clients. From 1995 onward, website-based activity became the norm, and those efforts were fundamentally altered.

Technology advanced quickly as the new millennium began—elevating internet trade. Fast executions, sophisticated graphing tools, and real-time quotes became standard.

A new breed of traders has now emerged as a result of the marriage of social media and online trading; these traders gain insights not only from charts but also from the wisdom of the crowd.

Platforms enable traders to copy the strategies of seasoned investors, transforming the market into a collaborative and competitive online environment. Trading overnight became a spectator sport wherein real-time success and failure stories are shared.

Interplay between social media and online trading

Social media evolved from a platform for sharing holiday images to one where trading ideas and market assessments are discussed as financial debates entered the digital sphere.

Online trading and social media are becoming intimate bedfellows in this brave new world, continuously altering one another. Retail traders now account for 20% of daily market volume, which is a 100% increase from 2019 in terms of the total number of retail traders.

The convergence presents unmatched opportunities and access to information, but it also necessitates a higher degree of knowledge. Black Banx is poised to guide traders through this treacherous path, assisting them in maximising the benefits of social media while minimising its drawbacks.

Black Banx on challenges of information accessibility

A new set of difficulties regarding the availability and validity of financial information emerge as online trading and social media merge.

Traders deal with the dilemma of choice, which is an excessive amount of information that might cause them to become indecisive. Further blurring the distinction between accurate analysis and sensationalism is the rise of social media influencers, which exposes traders to rash decisions based on transient trends.

Social media can affect entire market narratives, going beyond the influence it has on specific trading actions. A rush of investors chasing the newest trend or escaping a perceived threat might result from the herd mentality, which is magnified by online groups.

The top seven trading apps that are not affiliated with legacy investing firms saw a 126% increase in U.S. downloads between 2015 and 2019, according to Apptopia. Mobility restrictions brought on by the pandemic in 2020 and 2021 led to increased interest in financial applications.

There may occasionally be a discrepancy between market pricing and intrinsic value as a result of the market dynamics that ensue. A level-headed strategy that strikes a balance between strong financial judgement and popular sentiment is needed to successfully navigate this environment.

Black Banx, with a wealth of knowledge and a dedication to accuracy, supports traders in sifting through the noise, locating reliable sources, and making wise selections.

Future trends in online trading to look out for

When we look at finance, we can see how innovation, integration, and interconnectedness have transformed the trading environment. The evolution of online trading continues with these future trends to look out for:

AI and automation

Trading practises are expected to change as a result of the development of artificial intelligence (AI) and automation. The future arbitrators of trading choices will be algorithms that adapt to and learn from market data.

The analysis of complicated patterns, the discovery of hidden relationships, and the precise execution of trades are all capabilities of machine learning models.

Although the human touch won’t completely disappear, it will meld with AI’s binary brilliance to form a hybrid ecosystem where traders collaborate with machines.

Decentralised Finance (DeFi) disruption

Decentralised finance (DeFi) is poised to upend established financial systems as blockchain technology continues to develop.

With the speed and transparency of blockchain, DeFi platforms provide decentralised lending, borrowing, trading, and yield farming. Trading parties now have direct access to financial services thanks to the elimination of intermediaries through smart contracts.

As DeFi presents new opportunities and threats, Black Banx’s insights will be essential in navigating this changing scenario.

Virtual reality trading

Virtual reality (VR) and augmented reality (AR) have the potential to make trading a fully immersive experience. The ability to engage with data in three dimensions will allow traders to make decisions in a setting where the boundaries between the physical and digital worlds are hazy.

Democratisation of derivatives

Derivatives are a complex financial product that was once only available to big investors. Retail investors are now able to hedge, speculate, and diversify their portfolios with a new degree of complexity thanks to online platforms that are democratising access to derivatives trading.

The retail trader’s toolbox will increasingly include futures, options, and swaps, allowing more people to participate in the market.

Regulation and responsible innovation

A careful balance between innovation and oversight will be seen in future developments. Regulators will struggle to strike a balance between the advantages of new trading technology and the need for investor safety and market integrity.

In this changing environment, Black Banx’s dedication to ethical and legal trade will serve as a compass.

Conclusion

The difficulties in controlling information accessibility have gained attention. Today’s traders must sort through a deluge of data in order to make wise choices.

With knowledge of the difficulties and possibilities given by social media and online trading, traders can confidently navigate this dynamic environment. With Black Banx’s assistance, traders are better able to decide wisely and adjust to the constantly shifting dynamics of the online trading environment.