Not only did Saudi Arabia’s announcement of its $9.8 billion initiative to bring private capital into agriculture garner attention, but it also highlighted a strategic change that has been subtly accelerating across continents. Countries are no longer waiting for public funds to catch up as they deal with growing food insecurity, budget cuts, and climate disruption. They are strategically and voluntarily enlisting the help of private investors.

The need to build resilient water systems and restore degraded farmland has grown over the last ten years. However, there is still a huge financial disparity. The Food and Agriculture Organization estimates that restoring farmland will cost at least $105 billion, while meeting global water and sanitation goals will cost more than $400 billion annually. Without outside assistance, the math just doesn’t work for many governments, particularly those juggling debt and development.

| Topic | Description |

|---|---|

| Key Shift | Countries increasingly relying on private investment in agriculture and water |

| Financial Need | $400 billion per year for water; $105 billion for land restoration |

| Main Initiative | Brazil’s RAIZ Accelerator (launched at COP30) |

| Funding Approach | Blended finance, co-investment, public-private partnerships |

| Countries Involved | Brazil, Saudi Arabia, India, Ukraine, Germany, Peru, Canada, others |

| Goals | Boost food systems, modernize irrigation, restore degraded farmland |

| Featured Reference | FAO RAIZ Accelerator |

During COP30 in Belém, Brazil unveiled its RAIZ Accelerator, which is a particularly creative model. RAIZ is assisting ten nations, including Saudi Arabia, Germany, and Canada, in creating bankable restoration projects by combining funding from public and private sources. The project makes restoration efforts more appealing to investors who are concerned about climate risk by utilizing interactive data tools and public-private co-investment platforms.

The structure of this movement is what makes it so effective. These are well-thought-out frameworks that share risk, promote transparency, and yield quantifiable environmental returns—not mindless calls to speculators. For instance, the International Finance Corporation (IFC) has backed Ukraine’s efforts to restore its irrigation systems that were destroyed during the conflict. Ukraine is modernizing its infrastructure and restoring agricultural livelihoods in long-ignored areas by combining government strategy with private sector delivery.

A $1.8 billion agricultural investment plan in Southern Africa, backed by the African Union and FAO, focuses on climate-smart crop systems, mechanization, and improved irrigation. The opportunity is urgent and transformative, according to ministers like Anxious Masuka of Zimbabwe. These programs aim to radically alter how food systems operate, particularly in regions most severely affected by inflation and drought, rather than merely increasing food production.

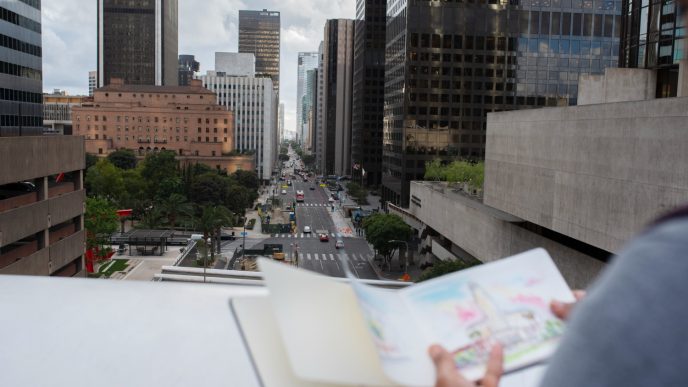

I recall being struck by how real the data felt as I browsed through pictures of RAIZ’s mapping dashboards. You could see where irrigation lines might reach, where pasturelands were recovering, and where yields could increase with investment. It gave a profound sense of reality to something as abstract as climate finance. The pictures affected me as someone who grew up close to a farm that was once thriving but is now inactive.

These initiatives are de-risking nature-based solutions by utilizing sophisticated analytics and co-funding models. This is significant because lengthy payback periods and uncertain returns make restoration projects unappealing to private investors. However, the equation is altered when real-time data, public guarantees, and insurance plans are combined. Investing in a reforested hillside or a watershed suddenly makes sense from an economic standpoint.

Public utilities in Chile and Brazil are collaborating with private companies to increase wastewater treatment and water access throughout Latin America. Although co-investment in agri-tech has increased yields in India, many smallholders still encounter access issues, which makes inclusive frameworks especially crucial. Driven by local policy reform and foreign investment, Gulf countries such as Bahrain and Oman are experimenting with agricultural innovation zones in the Middle East.

But not everyone is applauding. Critics warn that inequity may result from the privatization of vital resources like water or land restoration. These partnerships run the risk of alienating the very farmers and communities they are meant to assist if they are not properly managed. For this reason, community involvement, regulatory openness, and government oversight continue to be crucial cornerstones of any legitimate program.

Countries are redefining sustainable development through blended finance and strategic partnerships. It is now an ecosystem where public accountability, profit motives, and climate goals must coexist; it is no longer limited to budgets or aid. Success in the upcoming years will hinge on how well governments are able to strike a balance between these factors, not only to obtain funding but also to make sure that it gets to the places that need it most.

This change has a subdued optimism. Not because the issues have been resolved—they haven’t—but rather because the tools are getting better. Serious funding and more intelligent frameworks are now supporting projects that were previously viewed as being too slow or risky. Additionally, private capital typically follows public agencies when they share their maps, forecasts, and guarantees.

A new type of contract that is based on restoration rather than just returns is emerging. Investors are no longer merely observing from a distance. They are being asked to assist with rebuilding, irrigation, and sowing. Surprisingly, a large number of people are agreeing.